In context: Demand for GPUs and other AI accelerators isn’t expected to decrease anytime soon, and the cost of DRAM will be directly influenced by the strong “generative bubble” we are experiencing right now. Market intelligence company TrendForce has made some estimations for the third quarter of the year, and, unsurprisingly, prices are going up.

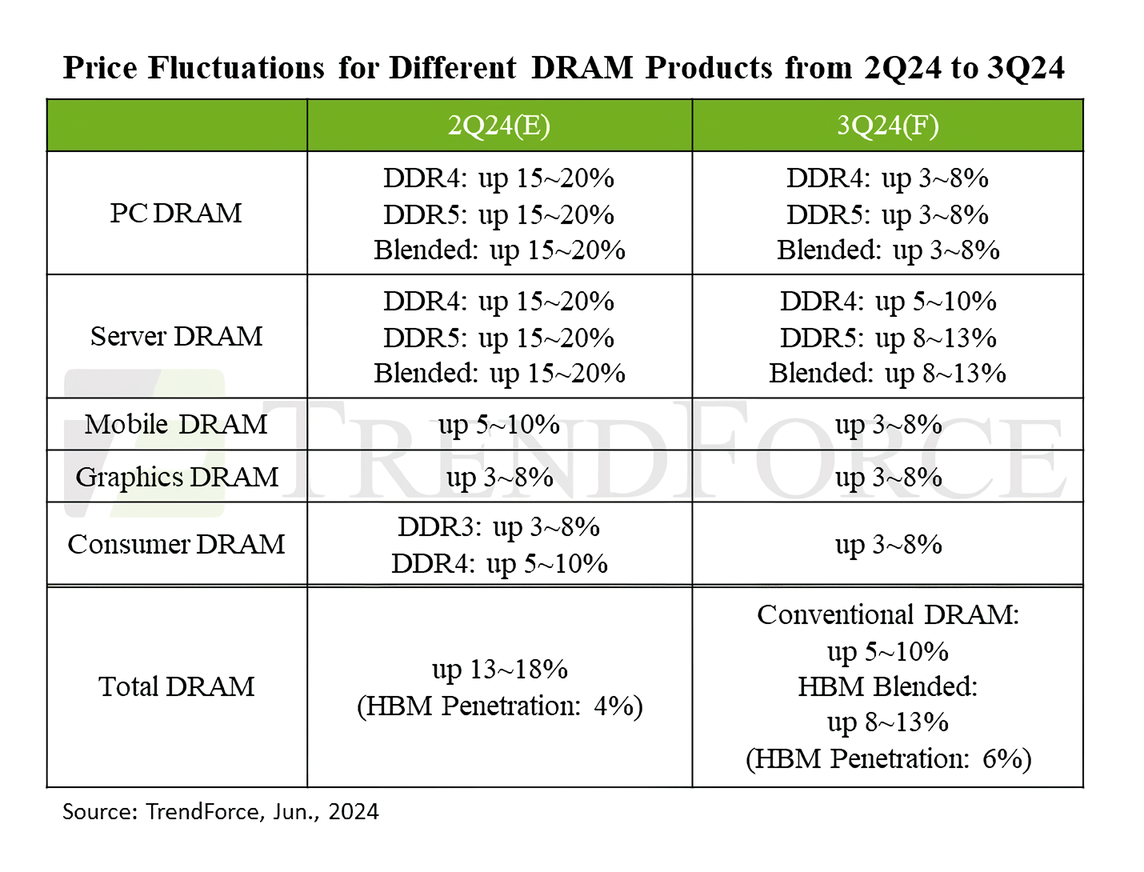

The latest TrendForce report predicts a slight increase in the price of DRAM products during the third quarter of the year. The company expects memory chips will experience a cost fluctuation of five to 13 percent year-over-year, with “conventional” DRAM memory seeing a five to 10 percent increase and all DRAM products (including HBM chips) experiencing an eight to 13 percent rise.

The main reason behind the price hikes is a recovery in demand for general server memory chips, coupled with an increase in the production share of HBM (high-bandwidth memory) products by major DRAM suppliers. The average selling price of DRAM during the third quarter is rising because manufacturers are keen on hiking their prices, although different types of memory products will behave in different ways.

TrendForce stated that PC DRAM chips will continue their upward trend with a three to eight percent price increase, as “general servers” are now in demand and memory suppliers are more focused on manufacturing HBM chips. PC customers can expect a smaller price hike compared to server DRAM buyers, as inventory for PC consumer products is higher and customer demand isn’t growing significantly.

Server DRAM products are expected to see an eight to 13 percent price increase. Storehouses are full of DDR4 chips, TrendForce said, which means that the Q3 “purchasing momentum” will mostly focus on DDR5. Mobile DRAM prices will experience a three to eight percent price increase, as inventory levels are still high while manufacturers are try to increase their profitability by influencing the supply-demand balance over the next year.

Prices for VRAM will increase by three to eight percent as well, TrendForce predicts, as overall demand for this kind of memory product remains “relatively flat.” Buyers have adopted a “continuous stocking strategy” that will bring costs down, while manufacturers are expected to increase adoption of new GDDR7 memory chips for the upcoming gaming GPU refresh cycle.

GDDR7 production costs 20 to 30 percent more than GDDR6, TrendForce said, and the increase in GDDR7 shipments for the new generation of GeForce RTX 50 GPUs will likely push ASP levels higher despite inventory strategies.

Finally, older memory products such as DDR3 and DDR4 will cost three to eight percent more. Taiwanese manufacturers are converting their production capacity to HBM, and the three main suppliers of memory chips are clearly interested in raising prices wherever they can.