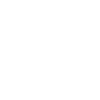

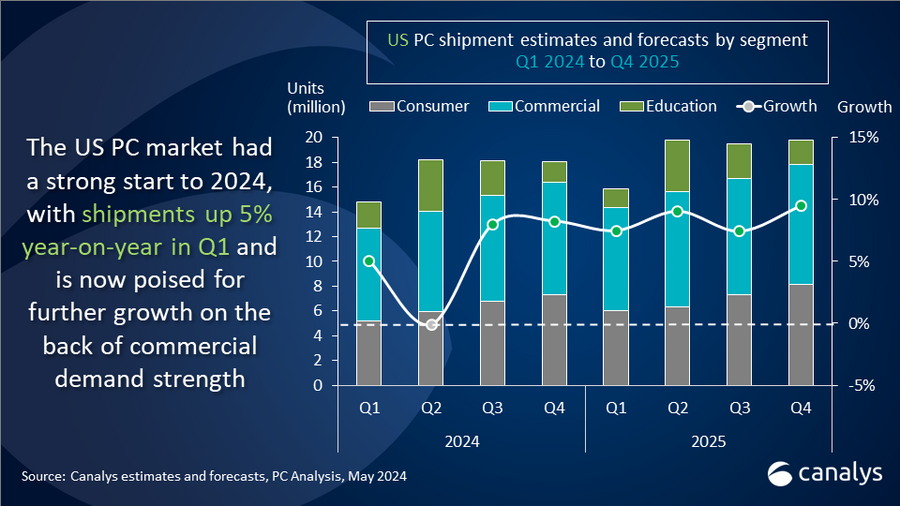

In a nutshell: Last year was a terrible one for PC shipments – the worst in the industry’s history, according to Gartner – due to a combination of economic and political uncertainty, lost consumer confidence, and the post-pandemic-boom hangover. But in a turn to positive news for the US PC market, it’s been revealed that sales grew 5% year-on-year to 14.8 million units in the first quarter of 2024. They’re expected to rise another 5% throughout the rest of the year, and a further 8% to 75 million units in 2025.

Analysts were optimistic about a recovery in 2024. According to Canalys, they were right: the expected 69 million PC shipments this year represents a 5% annual growth rate, while the predicted 76 million shipped units in 2025 is an 8% YoY improvement.

Much of the uptick is believed to stem from Windows 10’s end-of-support date on October 14, 2025. Those unwilling to pay the hefty prices for Extended Security Updates (ESUs) at this time will likely be moving to Windows 11. With the latest OS requiring hardware such as the TPM 2.0 module, many users may be forced to upgrade.

Another factor is the launch of new processor releases from AMD and Intel in 2024, and while not everyone is convinced by the new Snapdragon-powered AI laptops, their use of the current industry buzzword alone is expected to spur a new wave of PC sales among consumers.

“With a significant portion of the PC installed base still on Windows 10, the next four quarters are expected to bring even stronger momentum to the refresh cycle,” said Greg Davis, Analyst at Canalys “This timing also coincides with greater availability of on-device AI capabilities in the market, with new products and user experiences set to excite consumers and businesses across both the Windows and Apple ecosystems.”

Canalys included its usual look at the top PC vendors during the quarter. HP was top despite its annual growth shrinking slightly. It was followed by Dell, Lenovo, Apple, and Acer. It was a good quarter for Apple, which saw a 22% YoY increase in shipments.

| Vendor | Q1 2024 shipments | Q1 2024 market share | Q1 2023 shipments | Q1 2023 market share | Annual growth |

|---|---|---|---|---|---|

| HP | 3,639 | 24.6% | 3,733 | 26.6% | -2.5% |

| Dell | 3,596 | 24.4% | 3,801 | 27.0% | -5.4% |

| Lenovo | 2,594 | 17.6% | 2,119 | 15.1% | 22.4% |

| Apple | 2,102 | 14.2% | 1,723 | 12.3% | 22.0% |

| Acer | 811 | 5.5% | 787 | 5.6% | 2.9% |

| Others | 2,024 | 13.7% | 1,890 | 13.4% | 7.1% |

| Total | 14,766 | 100.0% | 14,053 | 100.0% | 5.1% |

Looking at tablets, Apple continues to dominate thanks to its iPad line. Cupertino holds more than half the market share due to its 4.9 million shipments, while second-place Samsung managed 1.8 million.

| Vendor | Q1 2024 shipments | Q1 2024 market share | Q1 2023 shipments | Q1 2023 market share | Annual growth |

|---|---|---|---|---|---|

| Apple | 4,928 | 50.8% | 5,404 | 50.0% | -8.8% |

| Samsung | 1,800 | 18.5% | 1,765 | 16.3% | 2.0% |

| Amazon | 1,601 | 16.5% | 2,041 | 18.9% | -21.5% |

| TCL | 389 | 4.0% | 602 | 5.6% | -35.4% |

| Microsoft | 262 | 2.7% | 375 | 3.5% | -30.1% |

| Others | 723 | 7.5% | 625 | 5.8% | 15.7% |

| Total | 9,703 | 100.0% | 10,812 | 100.0% | -10.2% |

After Apple apologized and removed its controversial Crush commercial for the new iPad Pro, Samsung released its own mocking response, called UnCrush.